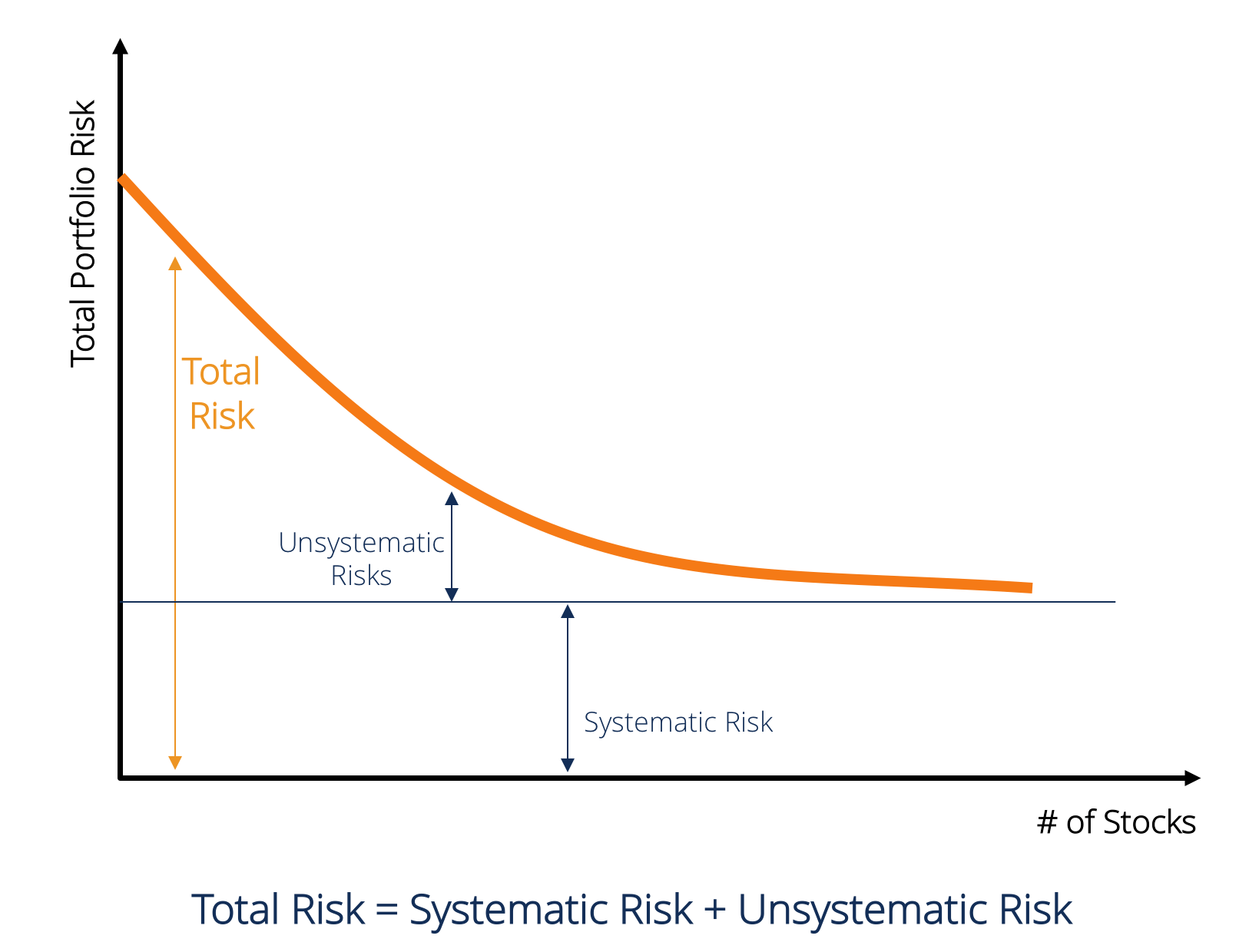

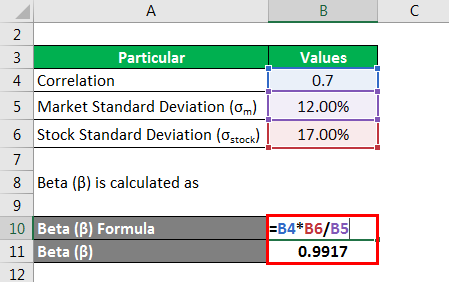

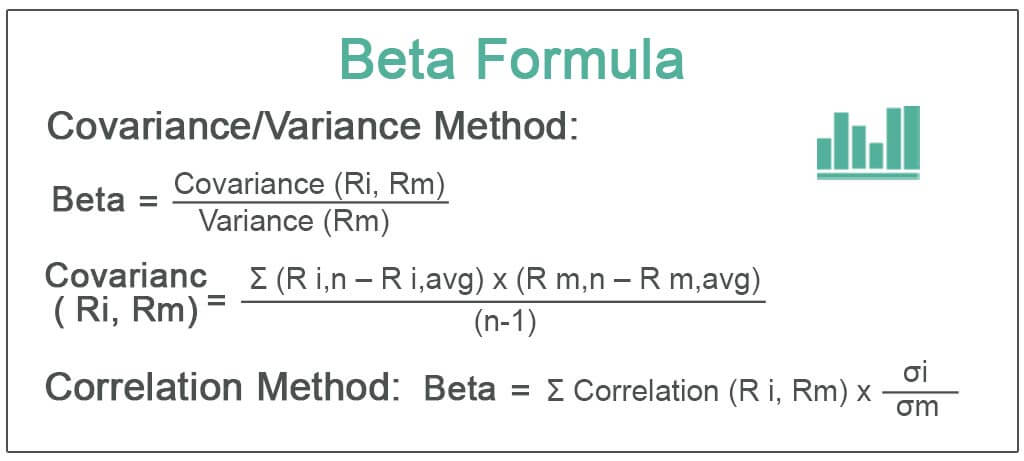

What is Systematic Risk (aka Beta)? How to Calculate Beta of a Stock? - Everything You Need to Know.

What is Systematic Risk (aka Beta)? How to Calculate Beta of a Stock? - Everything You Need to Know.

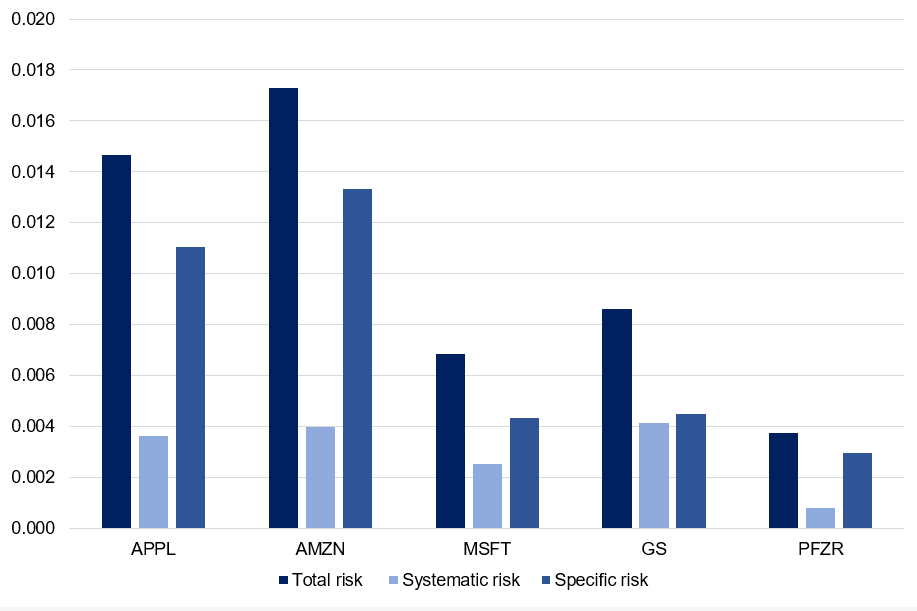

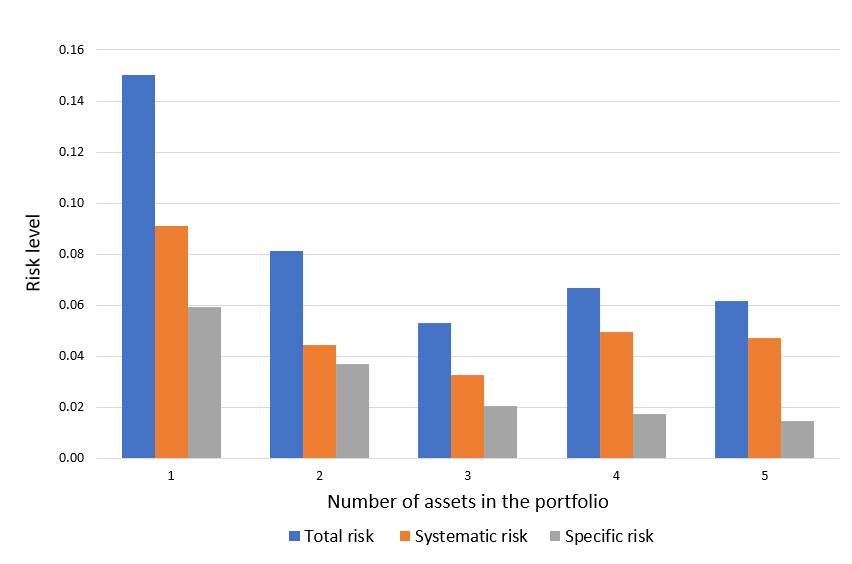

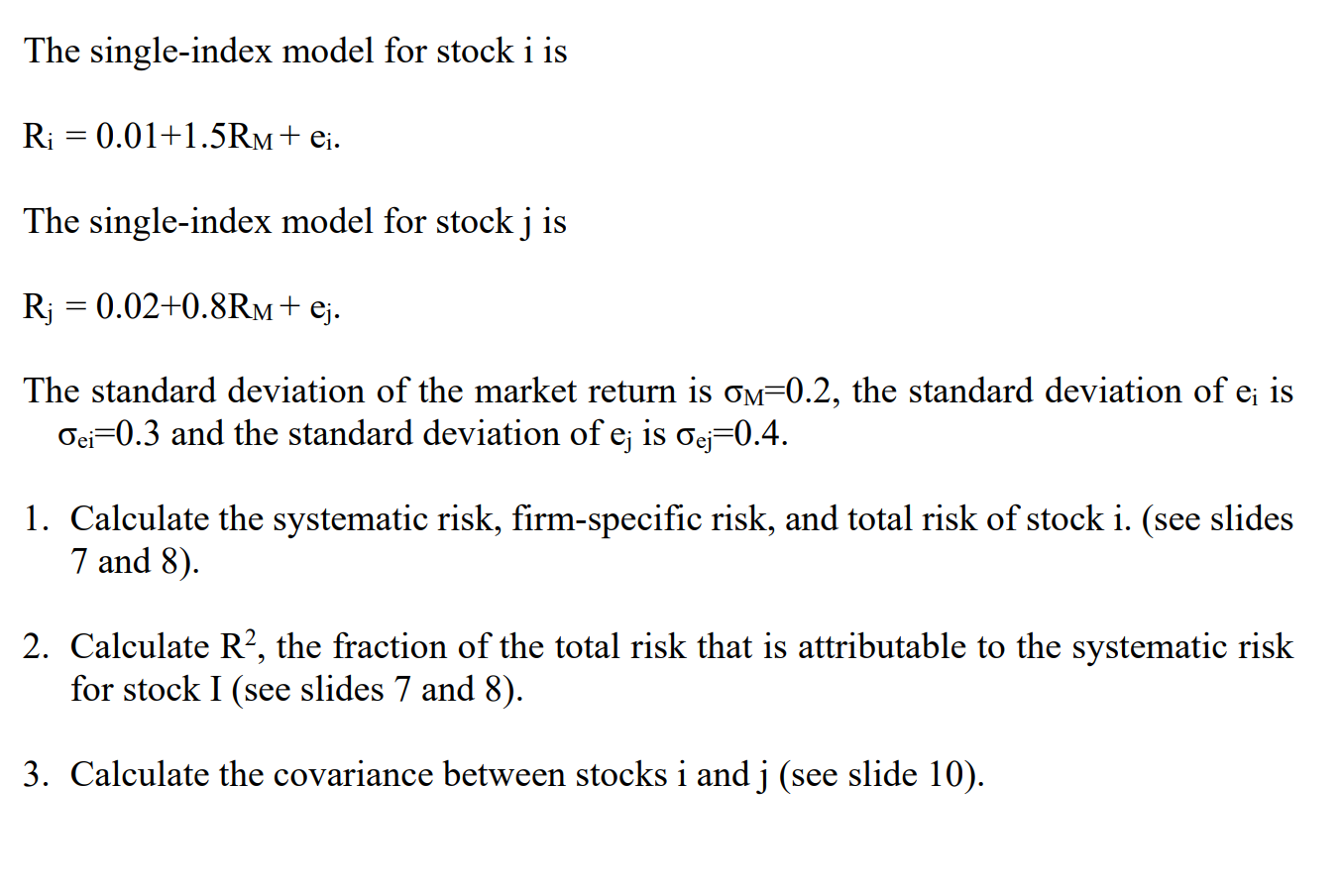

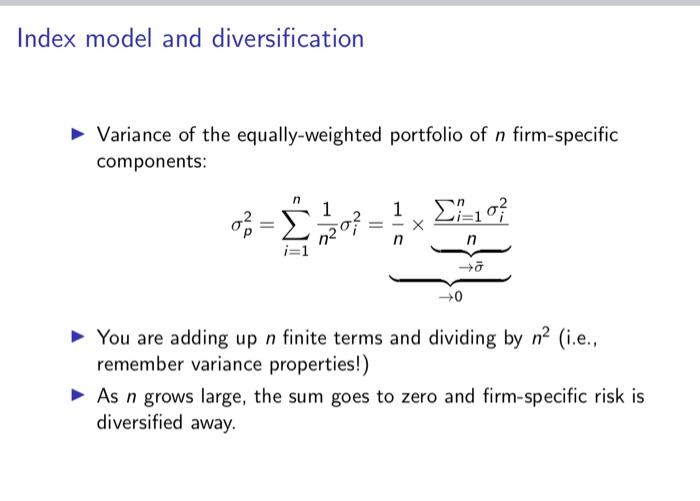

How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent | Finance Courses, Investing Courses

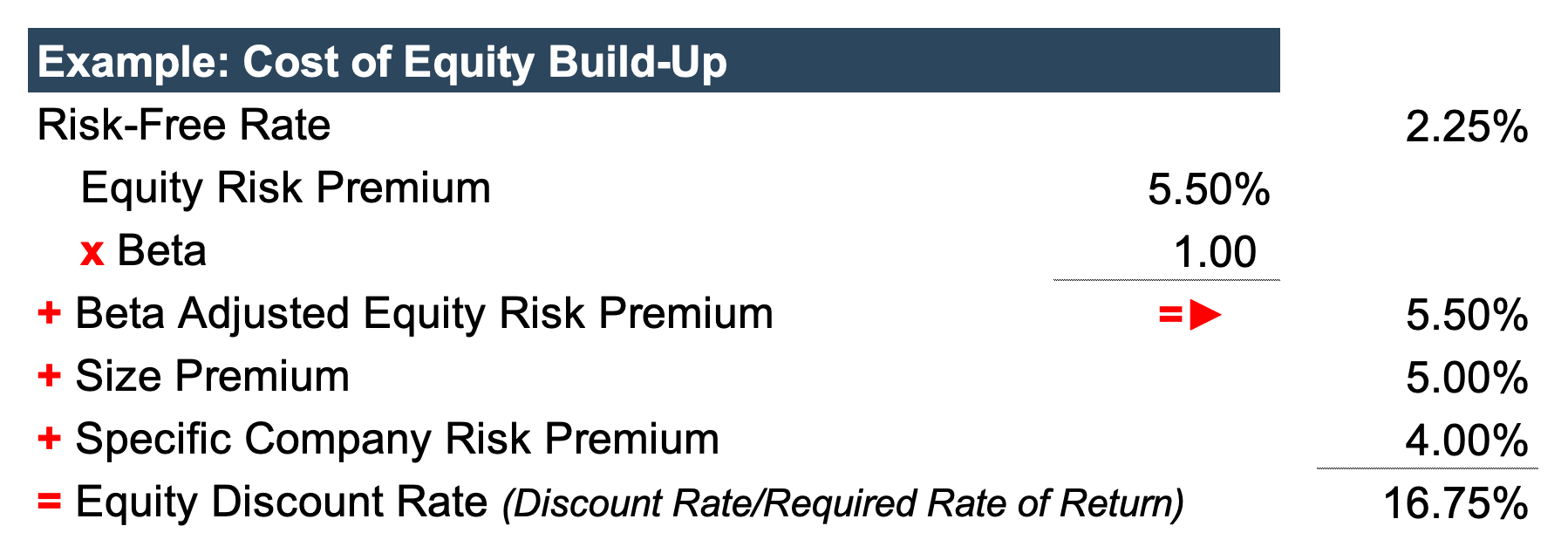

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

:max_bytes(150000):strip_icc()/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)